The Week on Wall Street

Shrugging off COVID-19 infections and the disruption at the Capitol on January 6, stocks powered higher to kick off a new year of trading.

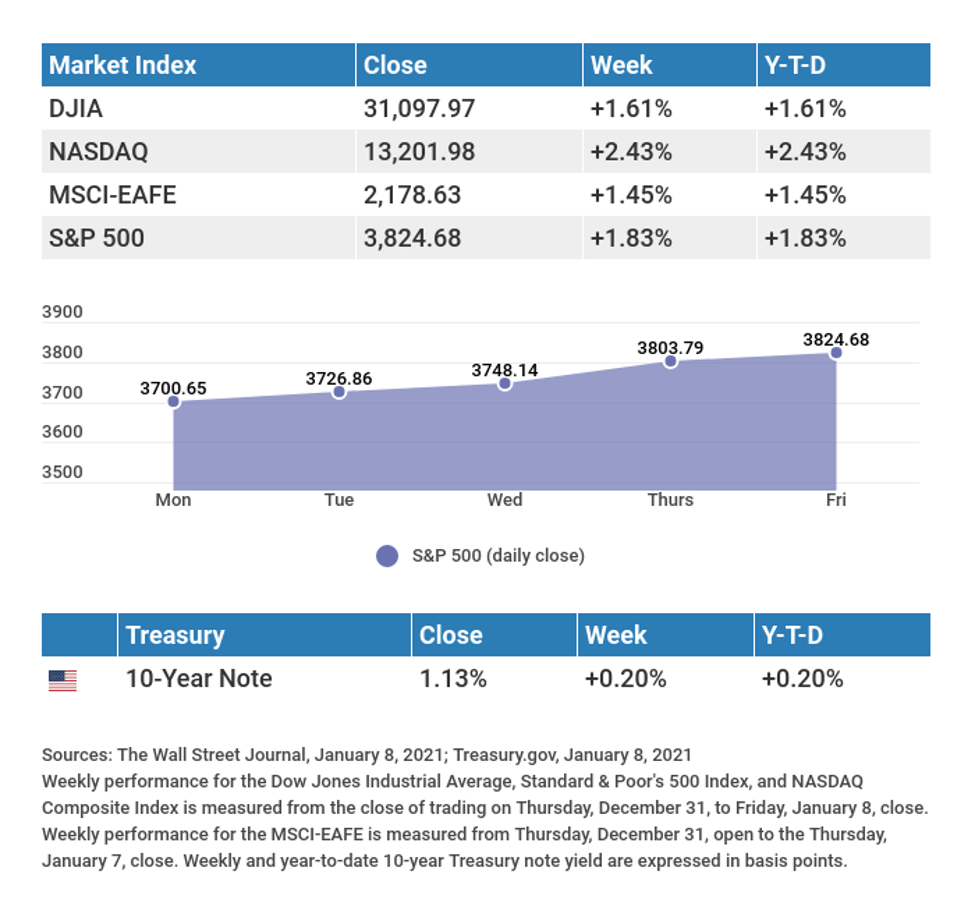

The Dow Jones Industrial Average gained 1.61%, while the Standard & Poor’s 500 increased by 1.83%. The Nasdaq Composite index, which led throughout 2020, picked up 2.43%. The MSCI EAFE index, which tracks developed overseas stock markets, rose 1.45%.[1][2][3]

Fireworks to Start the New Year

Stocks got off to an inauspicious start amid the stuttering pace of vaccine distribution and concern that the economic recovery might take longer than anticipated. Uncertainty over the looming Senate runoff election in Georgia added to the broad retreat that marked the first day of 2021 trading.

From there markets turned higher, aided by firming oil prices with subsequent support provided by the Georgia Senate election results, which lifted hopes of additional fiscal stimulus. Stocks managed through political unrest mid-week, with banks, economically sensitive stocks, and technology shares leading the way.

The yield on the 10-year Treasury rose above 1% for the first time since March as investors fled bonds in anticipation of new federal borrowing.[4]

Stocks touched all-time highs on the final trading day, capping a strong week of performance.[5]

Employment Picture

The U.S. economy lost 140,000 jobs in December, confirming fears of economic slowdown brought on by a resurgence of COVID-19 infections.

Not surprisingly, it was restaurants and bars that saw the greatest job losses, with the larger hospitality sector accounting for nearly all the job losses last month. Meanwhile, November job creation was revised upward, from 245,000 to 336,000.[6]

To help put the pandemic in perspective, December’s job report capped the worst year for job losses since the tracking began in 1939. The unemployment rate remained unchanged at 6.7%.[7]

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Consumer Price Index (CPI).

Thursday: Initial Jobless Claims.

Friday: Retail Sales, Consumer Sentiment, Industrial Production.

Source: Econoday, January 8, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: KB Home (KBH)

Thursday: Blackrock (BLK)

Friday: JPMorgan Chase (JPM), Citigroup (C), PNC Financial (PNC)

Source: Zacks, January 8, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The Wall Street Journal, January 8, 2021

The Wall Street Journal, January 8, 2021

The Wall Street Journal, January 8, 2021

The Wall Street Journal, January 6, 2021

CNBC, January 8, 2021

The Wall Street Journal, January 8, 2021

The Wall Street Journal, January 8, 2021

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.